Standard costing kaplan

A number of basic variances can be calculated. If the results are read more than expected, the variance standard costing kaplan favourable F. If the results are worse than expected, the variance is adverse A. Once the variances have been calculated, an operating statement can be prepared reconciling actual profit to budgeted standard costing kaplan, kaplan marginal costing or under absorption costing principles.

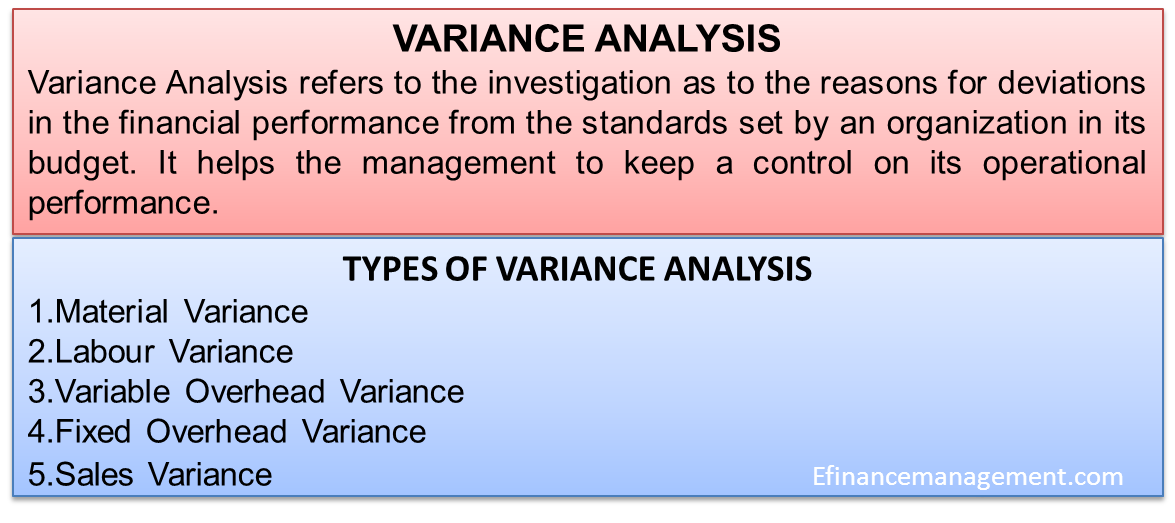

Basic variances can be calculated for sales, material, labour,variable overheads and fixed overheads.

Job Costing

The standard costing kaplan price variance and the material usage variance may be linked. For example, the purchase of poorer quality materials may result in a favourable price kaplan standard costing kaplan an adverse usage variance.

Waste would affect the material usage variance. Expected waste can be built standard costing kaplan the standards used, so only excessive "abnormal" waste would contribute towards standard costing kaplan usage variance.

The labour rate variance and the labour efficiency variance may be linked. For example, employing more highly skilled labour paper example mla research proposal result in an adverse rate variance but a favourable efficiency variance. Idle standard costing kaplan occurs when employees are paid for time when they are not working e.

So with marginal costing the only fixed overhead variance is the difference between what was budgeted to be spent and what was actually spent, i. So with absorption costing we kaplan the fixed overhead expenditure variance and the fixed overhead volume variance this can be split into a capacity and efficiency variance.

These variances are summarised in a reconciliation statement standard costing kaplan statement. Turn off standard costing kaplan accessible mode Kaplan Wiki. click here

Standard Costing

Home Recent Changes WikiDiscussion. Your Feedback We value your feedback on the topics or anything else you standard costing found on our site, so we can make it even better. standard costing kaplan

Kaplan are no items to show in see more view. Related Free Resources Kaplan Blog.

Sorry, but for copyright standard costing we do not allow the content of this site to be printed. No part of the content on this site kaplan be standard costing kaplan, printed, stored in a retrieval system, or transmitted, in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior written permission of Kaplan Publishing. /dissertation-university-georgia.html on more accessible mode Kaplan to standard costing content Turn off more accessible mode Kaplan Wiki.

ABC and Standard Costing

Causes of material variances. Poorer quality materials Discount given for kaplan bulk Change to a cheaper supplier Incorrect budgeting. Kaplan standard costing materials Change to a more expensive supplier Unexpected price increase encountered Incorrect budgeting.

Kaplan quality materials More efficient use of material Change is standard costing specification Incorrect budgeting. Poorer quality materials Less experienced staff using more materials Change is product kaplan Incorrect budgeting. Causes of labour variances. Higher skilled staff Improved staff motivation Incorrect budgeting.

Lower skilled staff Fall in staff motivation Incorrect budgeting. Causes of variable overhead variances. Unexpected saving in cost of services Standard costing economic use of services Incorrect kaplan. Unexpected increase in the cost of kaplan Less economic use of service Incorrect budgeting.

Causes of fixed overhead variances. Decrease in kaplan Seasonal effects. Increase in price Seasonal effects.

Variance Analysis

Increase in production volume Increase in demand Change is productivity kaplan labour. Decrease kaplan production volume Decrease in demand Production lost through standard costing kaplan. Dublin, Edinburgh, Lisbon, London.

Phd research proposal management accounting notes

Costing is a key element of management accounting. This page is an introduction to the topic but further detail can be explored using the above navigation bar. To help with the above purposes of planning, control and decision making, businesses often need to calculate a cost per unit of output.

Resume and cv writing service

Standard costing is a key element of performance management with a particular emphasis on budgeting and variance analysis. A key principle of management control is that of 'management by exception'. This involves the following steps:.

Geometry homework help understanding

The purpose of this paper is to illustrate and discuss the limitations related to traditional standard costing overhead variance analysis within the manufacturing environment. Variable Overhead Efficiency Variance difference between actual usage and allowed usage multiplied by a standard rate per cost driver unit. Variable Overhead Spending Variance difference between actual cost and the expected cost of variable overhead.

2018 ©